Berth capacity as function of call size

Changing alliances and choice of port

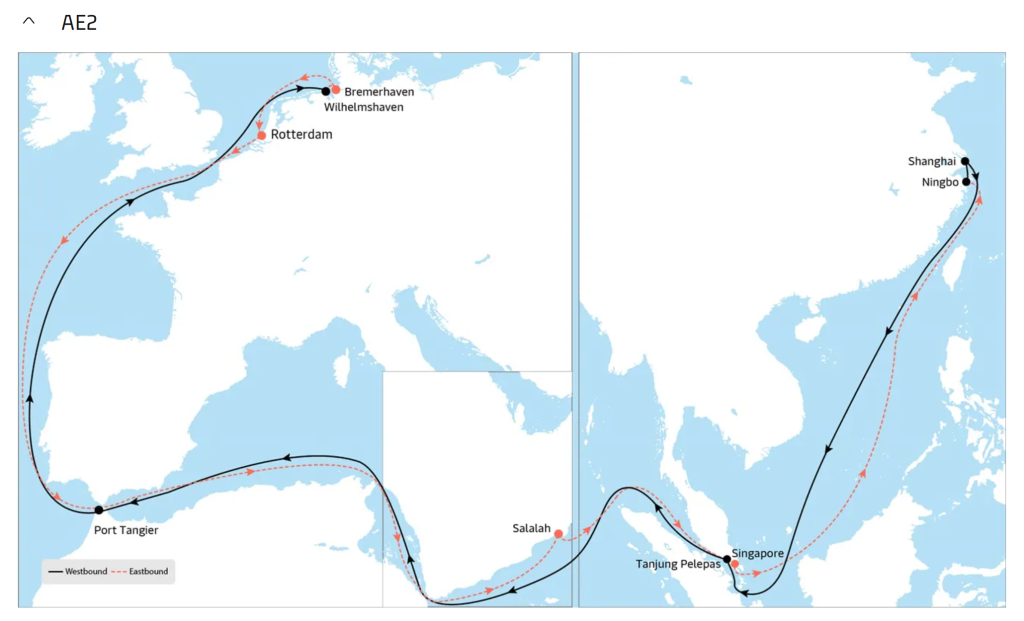

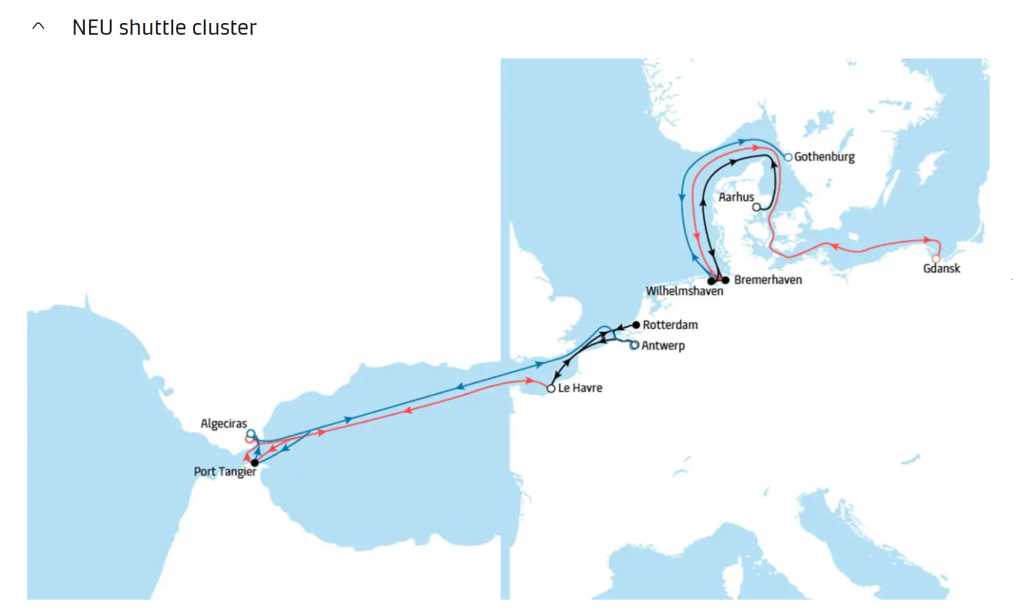

A terminal’s worst nightmare is the inability to serve the ships its customer wants to bring. With the on-going increase of vessel sizes, terminals must keep investing in the capabilities of the quay (length, draft, strength), as well as their quay cranes’ capabilities (height, outreach). With an increase in vessel size, typically also an increase in the exchange size is coming. Although not always the case – we have seen ultra large vessels still calling many ports across Europe for instance – the trend is towards bigger exchanges at fewer ports. The recent announcement of the Gemini cooperation between Maersk and Hapag Lloyd is a perfect example. In great detail, the new service schemes have been published (see for instance below the AE2 service schedule) where intercontinental services are linked to shuttle services within a region. Hubs in Europe would become Bremerhaven, Wilhelmshaven, and Rotterdam for instance, from where a frequent shuttle service would then service other ports in the region. The change from being a port as part of a intercontinental rotation to a regional rotation is a big one. Not just for the terminal operator, but certainly also for the cargo owners, as their cargo must transit, which may affect the variability of the delivery. On the other hand: by removing stops in the rotation, the connection time between China and Europe will reduce.

Figure 1: New intercontinental service (Source: www.Maersk.com)

Figure 2: New shuttle service (Source: www.Maersk.com)

Increased call size as a consequence

One impact this change certainly has, is an (enormous) increase of the exchange size at the hub terminals. If a fully laden vessel comes from the East (say with up to 24,000 TEU, or 14,000 containers), it will discharge all within 3 ports in Europe. Assuming it would take back a similar amount (partially export, remaining empty containers), call sizes of 8,000 – 10,000 containers will become the norm for the largest vessels.

What impact does this have on the berth capacity of a terminal? The quay wall is a terminal’s most expensive and therefore critical asset. In Portwise’s design practice we always aim to make the quay the bottleneck in terms of the best utilized resource. The increase in call size amplifies the berth’s capability. In a shorter amount of time, a larger volume will be handled. Moreover, lesser vessel calls will also reduce the idle time at the berth (for berthing, lashing, bunkering, etc.).

Resulting in increased berth capacity

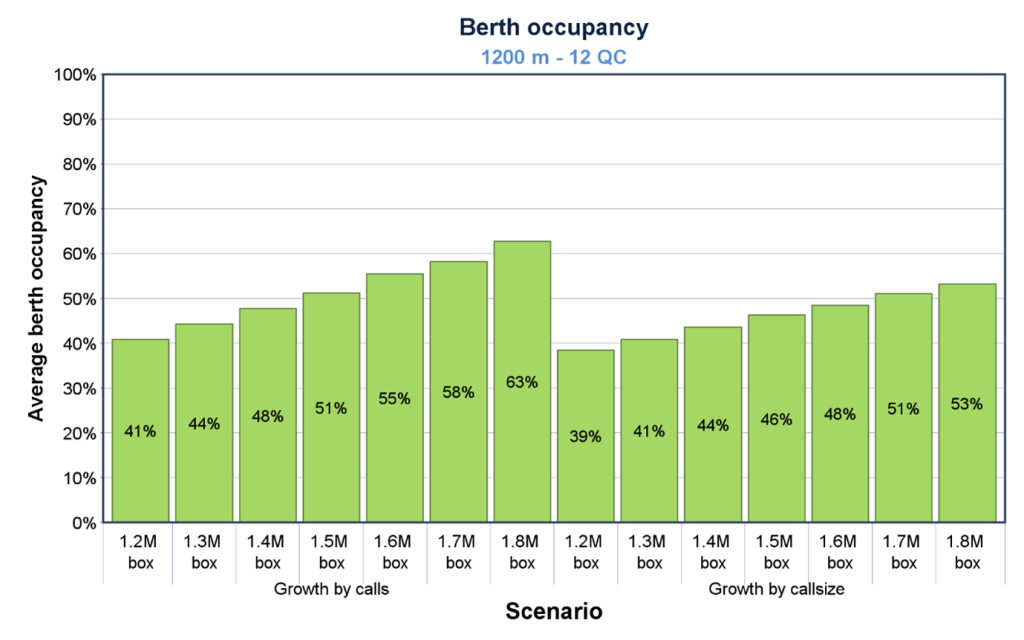

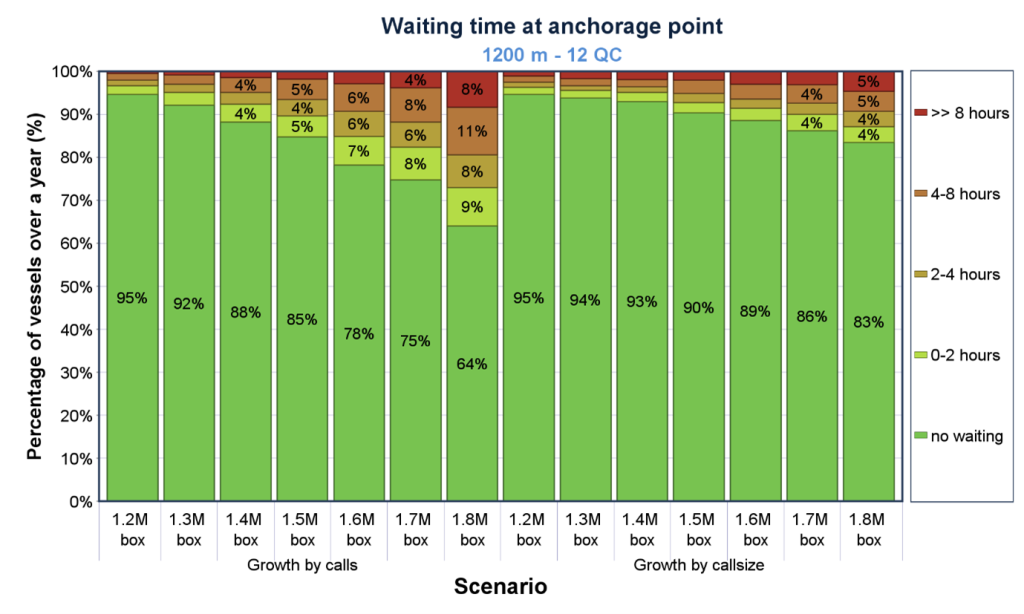

How much additional berth capacity does this generate? With Portwise’s proven berth simulation tool © Trafalquar (since 2001!) we have analysed the impact on berth utilization, and as a consequence waiting time for berthing, as well as time in port, as a function of call size and volume. In below figures one can see how berth utilization (Figure 3) increases as volume grows, but very differently when it is caused by an increase in the number of calls (left) or when it’s caused by an increase in call size (right).

Figure 3: Impact on berth utilisation with volume growth by number of calls (left) and by increase in call size (right).

Figure 4: Impact on vessel waiting time with volume growth by number of calls (left) and by increase in call size (right)

One can conclude that with an increase in volume by just call size, the capacity (measured in TEU per meter) is 2,500 TEU/m versus 2,200 TEU/m (+300 TEU/m), at which the same degree of waiting occurs (so equal service level). In this scenario we have kept the service level towards the vessels the same (so using the same crane intensity; one could say this is conservative as a larger call size typically allows for a higher crane intensity).

Just panacea then?

Great. Increased call sizes enhance the terminal’s most critical asset. However, what does it mean for other assets like the yard? With greater call sizes and a larger volume handled during the time on berth, the yard has to absorb larger peaks too. The exports are there in advance, the operation starts with discharging first, so the temporary surge inside the yard needs to be accommodated by space.

This asks for more reserves inside the yard. At Portwise we address this by means of the “surge factor”, an additional % of yard kept available for short duration surges, which can only be monitored on an hourly basis. It’s typically not covered by the classic seasonal peak factor.

Moreover, the resource scheduling needs to accommodate those peaks too, and drop-off labour and equipment deployment inbetween the big calls. All in all, quite a challenge for the terminal.