Electrification for Container Terminals:

The Challenges Go Beyond Looking Into the Power Consumption vs. Charging Time

Electrifying terminal equipment is increasingly being considered within the logistic industry as pivotal on the path towards carbon neutrality. Nevertheless, we encounter frequent under-estimations of the challenges in terminal’s planning for electrification roadmap.

Portwise has previously highlighted that the road to carbon zero is not just as simple as buying electric terminal equipment. To the contrary, carbon neutrality first requires proper detailed assessments of electrified terminal equipment operation/charging against terminal specifics and performance requirements.

Determining power consumption, charging time, and fleet size is just the start. Container terminal electrification involves complex challenges across operational, infrastructural, and financial levels. A successful plan requires balancing these factors, as a lack of holistic and comprehensive perspective often creates obstacles in our industry.

In this blog, we select the following four challenges to discuss further, highlighting the importance of a systematic approach to container terminal electrification:

- Increased power demand

- Charging infrastructure required for mobile equipment

- Lower productivities and reduced flexibility

- More expensive equipment

Background Context

Sustainability is quickly becoming a license to operate for more and more container terminals all over the globe. The European Union is mandating shore power supply to berth vessels over 5,000 tonnes and aims to be carbon neutral by 2050. The United States have a similar aim, presented as in the “Pathways to Net-Zero Greenhouse Gas Emissions by 2050” (November 2021). Worldwide, 196 countries have signed the Paris Agreement of 2015, legally binding them to fight climate change and reduce carbon emissions.

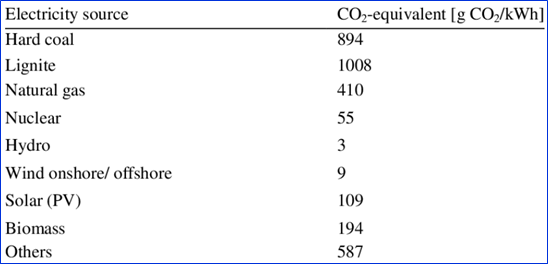

Electrification is vital for terminals’ wishes to reduce their carbon footprint. Taking as an example one truck with a diesel engine and one powered by electricity, an average diesel truck consumes around 30 litres of fuel for every 100 kilometres travelled. For the same distance, a state-of the-art electric truck will use around 110 kW/h of electrical power. Michelin estimates that on average, 2.5 kilograms of CO2 are emitted for every litre of diesel used. On the other hand, emissions per kW/h differ strongly depending on how power is generated. For example, generating electricity from hard coal emits almost 900 grams of CO2 per kWh, whereas nuclear power only emits 55 grams and hydro power only 3 grams per kWh. Taking the average so called power generation factor of the 27 EU member states, one kWh of power leads to 300 grams of CO2 emissions.

Image: Emission factors per electricity source. Source: GEMIS 4.95, IINAS, Öko-Institut e.V., 2016

All combined, this means that the diesel truck would emit 75 kilograms of CO2 for every 100 km covered, versus 33 kilograms for the electrical truck – i.e., a reduction of 56%. Additionally, the power generation factor will be significantly reduced globally over the coming decades. As such, it becomes clear why electrification is a hot topic for so many terminals.

The Challenges for Container Terminals Electrification: A Selection

1.1 Increased Power Demand

Replacing fuel powered equipment with electrical terminal equipment means that the power grid will suddenly face additional demand. This may lead to two different problems. First of all, the extra power must be generated by the providing power plant. If a container terminal replaces 5 diesel powered mobile harbour cranes by electrical ones that will each be operational for 5,000 hours, the terminal must supply around 5 x 6 x 15 * 5,000 = 2,250 MWh of additional power per year, assuming the cranes use 6 kWh per move and do 15 moves per hour. This power either has to be made available by the existing supplies, or new ones must be found. For large electrification projects and multiple terminals electrifying around the same area, this could be a difficult and time-consuming process. Proper planning and communication with suppliers is critical to prevent problems.

Next to the challenge that the total amount of power required must be generated. It is also important to know when peak power demands occur and how much power is required in those peaks. In the previous example, each mobile harbour cranes uses an average of 15 x 6 = 90 kW when in operation. When idle, however, power consumption is very limited. This means that peak hours, when multiple vessels are being serviced and all cranes are active, 5 x 90 = 450 kW is required, much higher than the yearly average power consumption per year, which is 257 kW. Of course, power supply must cover the peaks, which is especially challenging if multiple terminal operators within the same area have their peak hours around the same time.

Taking even smaller time steps, rather than looking at consumption in the peak hour, we must also consider the so called one-second peak that occurs when a machine uses its maximum engine power. Once again taking the example of a mobile harbour crane, although the average power used during operation is 90 kW, up to 750 kW may be used by certain cranes when the acceleration of the hoist is maximal while the crane is also rotating. Theoretically, this means the 5 cranes together could at some point be using 3,750 kW, which must be supported by the grid infrastructure in order to prevent a power outage. In practice, the probability that all cranes are at full power simultaneously decreases sharply as more cranes are in operations. To correct for this, we can use a simultaneity factor between 0 and 1 that differs per fleet size. For example, if the corresponding simultaneity factor for 5 mobile harbour cranes is 0.6, then a static estimation for the one-second crane power peak is 0.6 x 3,750 = 2,250 kW. If a mor

1.2 Charging Infrastructure

Adding charging infrastructure will not simply be proportional to the number of additional electrified CHE. Numbering of charging slots is a delicate exercise itself, depending on factors such as operational time and shift scheme, consecutive peaks, and charging strategies.

Recent ZEPA publications have defined four charging archetypes: vehicle rotation, depot charging (during fixed breaks), fast opportunity charging, and battery swapping. Besides these, new technologies such as conductive and inductive charging emerge and enable even more possibilities. To determine what charging technology and strategy best suits a particular container terminal site is not easy.

A natural follow-up question is how charging all these mobile terminal equipment can be managed with other power demands, given the total grid capacity. The quoted ZEPA publications highlight a checklist of datapoints needed to profile the power demand and gives high-level guidelines for power infrastructure.

Yet, further designing and engineering of the charging infrastructure still need to consider various dynamic factors and nuances of terminal operations and equipment charging. To just name a few:

- Charging capabilities/rate: what mobile equipment terminal deploys (e.g. terminal tractors, straddle carriers, empty handler, Reach Stackers) determines considerations in the first place (e.g., AC/DC, power rage from lower watt to megawatt charging)

- Non-linear charging curves and other dynamics influenced by external conditions such as temperature, etc.

- Charging success rate and charger uptime: Even nowadays charging success rate can reach above 95%, locking / communication / charger issues could still occur, which results in unexpected disturbance and impact to operation.

Integrating these elements with the broader infrastructure presents a complex challenge.

Often dilemmas come to place what to address the increased power demand vs. the infrastructure capacity – for example:

- To implement alternative strategies and peak shaving optimisations in equipment deployment, operation, charging, power usage: however cost-effective they may be, terminals are often concerned with potential risks from interruptions from implementing those in a live environment;

- Or to utilise battery/electricity storage and microgrid solution: despite often being (regarded) an expensive solution, its straightforwardness still leads to preference by sites with much lower risks in comparison to above.

Another challenge, which is not often considered by OEMs but emphasised by container terminals, is the space lost due to charging infrastructure installation, especially if it causes prime storage capacity to decrease. To find a solution to compensate for the capacity loss becomes a hardcore need yet a challenge, given container terminals are often space constrained.

1.3 Lower Productivities and Reduced Flexibility

The productivity of electric container terminal equipment is typically lower than that of fuel-power equipment. There can be multiple reasons for this. First, battery power equipment must at some point be charged. Ideally, this would be done during breaks or outside operating hours. Usually though, mobile equipment is required to be operational for a longer time than the capacity of its battery, even if charged during breaks. This means that the battery must either be swapped or charged during operations, which cuts into productive time. Second, if charging is not necessary because machines are connected to the power grid directly, productivity may still decease after electrification because certain unproductive processes take more time. Consider for example block changing RTG cranes on container terminals. Diesel cranes must carefully cross and turning wheels may take some time, but there is no need to unplug an plug from one block to the other. For electric RTGs with a busbar connection in particular, this

The example of busbar RTGs illustrates another disadvantage of electrical equipment: reduced flexibility. Because of the required grid connection, the machines are less free in their movements. Typically, container terminals try to keep RTGs assigned to particular blocks as much as possible. During peak hours, this has few implications. Off-peak however, flexibility to change blocks easily is much more important. Furthermore, reduced flexibility is a challenge in the terminal design planning. Busbars and infrastructure such as charging locations and substations are typically very difficult to move, meaning stacking locations become more rigid. Careful planning in the design phase is of great importance. Container terminal simulation can be used to validate designs in multiple scenarios to ensure the desired robustness to potential changes.

1.4 Difficulties Creating a Business Case

Although this may change as technology develops, prices of electrical equipment are currently still significantly higher than those of fuel-powered equipment. Next to the machines themselves, investments in electrical infrastructure and chargers are also considerable. On top of this, to compensate for charging during operations, extra electric machines must be bought to prevent losses in productivities.

On the other hand, governments and other authorities may partly subsidize purchases of electrical terminal equipment, such as Port Electrification Grants by the Environmental Protection Agency in the United States. These are reducing differences in costs with diesel equipment. Moreover, operational costs such as fuel and maintenance costs are typically lower for electric machines. Finally, the extra equipment required means that electric machines will on average have fewer operating hours per year compared to the fuel-powered counterparts. This extends their lifetime, reducing costs of ownership per machine.

Altogether, without either subsidies or a mandate from local governments and authorities, it is typically very challenging to find a business case for electrifying equipment, especially for transport vehicles. Investors that focus only on financial returns in the short to medium term are likely not interested in spending large sums of money if there are no clear rewards in the near future.

Conclusion and Looking Ahead

We select these four challenges of electrification for container terminals in this blog to highlight what we often hear from ports and terminals. To address these challenges with proper assessment and sufficient insights first are prerequisites for electrification rollouts. Yet, we did not give any answers how to address these challenges in this blog. From our experience, there is simply no one single answer that would fit all. To understand each individual terminal’s needs and characteristics is essential to find the best solution to each case. All in all, we believe that although each challenge remains complicated to solve, optimal solutions can be still found when a systematic and holistic approach is applied in the planning.

Take the Guesswork Out of Your Terminal Electrification Investments

Let’s explore how simulation and strategic consulting can help you invest with confidence and play a vital role in supporting progress towards global circularity and net-zero targets.